OPECs Standing Firm ��� Energy Journal

That is not the only aim of OPEC,��� he said. ���We are concerned about the. Canadian Natural Resources Ltd. said on Monday that it still expects overall output to grow beyond 2014 levels, and it pledged to keep spending on expanding output at its.

Five Energy Explorers With Strong Balance Sheets

While the key leading indicator of the rig count -- drilling-permits activity -- has declined sharply from October highs, we note that there has been a sharper decline in vertical versus horizontal permits. Meanwhile, horizontal permits in December are.

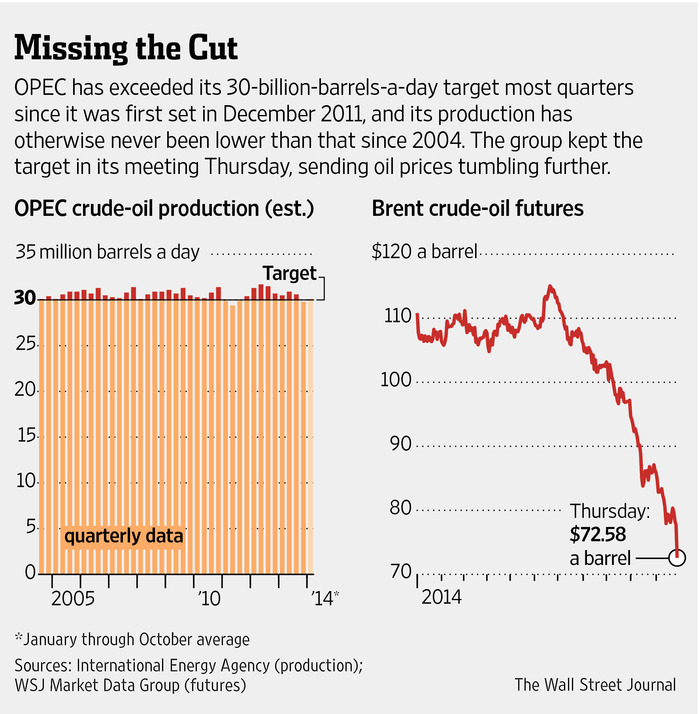

Oil tumbles as Opec leaves production levels unchanged.

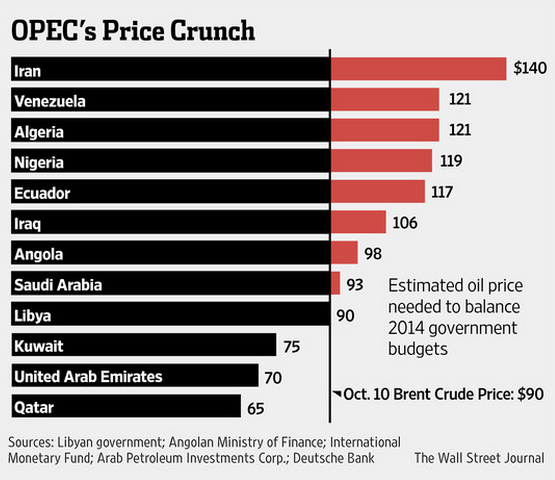

The oil price has plunged this afternoon after the Organization of Petroleum Exporting Countries (Opec) decided not to cut production levels (see 3pm onwards for highlights). At a five-hour meeting in Vienna,. In the long term, the decision could help Opec fight back against the rise of the shale oil industry, as a lower oil price will probably rein in their output.. ���Opec just declared war on everyone-including itself���, says the Wall Street Journals Liam Denning. Todays��.

Obama Lays Smackdown on the Energy Industry

These include stricter controls on hydraulic fracturing, new rules covering oil shipments by trains, and tougher standards on offshore drilling and drilling in the Arctic, reports The Wall Street Journal. Below is a summary of all the new regulations.

Shale Gas Fracking Will Be Around For a Long, Long Time.

The most exhaustive study to date of a key natural-gas field in Texas, combined with related research under way elsewhere, shows that U.S. shale-rock formations will provide a growing source of moderately priced natural gas. A report on the Texas field, to be released Thursday, was reviewed by The Wall Street Journal.. Oops--Turns out the shale gas and oil play has been massively pumped up in the press with breathless hype the US is the Saudi Arabia of Gas!

Barrons Roundtable: Masters of the Game

WSJ LIVE.. If you have taken the time to peruse this years spiffy artwork, youll note a new face in the crowd, that of David Herro, Harris Associates chief investment officer, international equities, and manager of the renowned $28 billion.

Marcellus and Utica Shale Story Links: Thu, Oct 23, 2014.

NGIs Shale Daily Top regulators from Oklahoma, North Dakota and Ohio all agreed on Tuesday that unconventional oil and gas development in their states shows no signs of slowing anytime soon. That was the message offered during. The Wall Street Journal Drillers for Pennsylvanias natural gas are facing a growing threat���from their own productivity. Hydraulic fracturing and other new drilling techniques have caused the amount of natural gas flowing out of the��.

Coming to Terms With the New Oil Reality

The shale boom in the U.S., where oil production has nearly doubled over the past 10 years, and the refusal of the Organization of the Petroleum Exporting Countries to cut output, have contributed to a glut on global energy markets. At the same time.

Deep Debt Keeps Oil Firms Pumping

WSJs Nicole Friedman and Geoff Rogow discuss on the News Hub.. But oil is languishing at five-year lows���the U.S. benchmark fell to $47.93 on Tuesday���and natural-gas prices have fallen by 40% since June from about $4.70 per million British thermal.

Saudi shock and awe slams oil; nat gas gets burned

OPEC talked down the oil market, sending crude sharply lower, while warm weather and growing supply battered natural gas prices.. riddles Saudi Arabia. Now the Saudi Arabians are trying to destroy our shale oil industry.. ERMO. No but if you would like to research or read about the issue both The Economist and the Wall St Journal have detailed the perfidious Saudi connection to falling oil prices and the strategic reasons for their complicity in over production.

TSX Ends Sharply Higher On Rate Cut, ECB Hopes -- Canadian Commentary

A Wall Street Journal report, citing people familiar with the matter, said a new bond-buying program has been proposed for the eurozone economy, with monthly bond purchases of about 50 billion euros or US$58 billion for a minimum period of one year.

OPEC Reacts To American Shale Boom - Business Insider

Americas shale boom is sending shockwaves through OPEC as the organization heads for its annual meeting Friday, The Wall Street Journal reports this morning. The main concern is that a global supply glut will weigh down��.

At A Glance Films That Explain Important Energy Issues

The producers and writers of the film have said in interviews that they were heavily influenced by the 1973 oil crisis that took place when the Organization of Petroleum Exporting Countries (OPEC) announced an oil embargo against the U.S. and some of.

The First Shale Casualty: WBH Energy Files For Bankruptcy.

And now, as The Wall Street Journal reports, the bankruptcies have begun as financing costs are not just prohibitive, there is no liquiidty available at any price for many. American oil and gas companies have gone heavily��.

As Oil Slips Below $50, Canada Digs In for Long Haul

Canadian Natural will continue expanding production because it expects higher volume will cut operating expenses at its mainstay Horizon mine, currently at 37.13 Canadian dollars a barrel, by at least another 10 Canadian dollars a barrel. ENLARGE.

Freaking About Fracking: The Natural Gas Revolution.

. not the only ones freaking about shale gas fracking. So are Gazprom (Russias giant natural gas company), OPEC and other oil producers, and the coal mining magnates of Australia and southeast Asia.. And it is just not shale gas that is producing the sudden change, although it has been getting all the headlines. As regular readers of our weekly Waste to.. Wall Street Journal Russia Sounds Alarm On Shale Gas. Earths Energy will continue to follow the natural��.

Competition Between OPEC, U.S. Drives Oil Prices to Four.

And just yesterday, speculative U.S. presidential candidate Jeb Bush told the Wall Street Journals CEO Council he backs lifting the export ban ���at the appropriate time.��� By holding production steady amidst very low global oil prices, Saudi Arabia and its OPEC allies have indicated that they will not take the U.S. assault on their market share lying down.. What does impact renewables is the price of natural gas, which is used to produce 27 percent of U.S. electricity.

UAE Minister Says OPEC Wont Change Output Decision

Mr. al-Mazroueis comments come in the wake of a continuing glut in oil markets which has OPEC members facing off with the American shale boom that has significantly boosted U.S. oil production. OPEC controls more than one-third of global oil production.

Three Resilient Rails With Double-Digit Upside

While we will be the first to admit that we, too, had our ���shale goggles��� on when we made a bullish call on the rails related to growth opportunities along the natural-gas value chain back in March 2014, the core elements of our thesis still hold true.

Shale vs OPEC: Whats going on with oil prices? Will the.

���Im not going to give you a price but I would suggest something we all know, that the shale oil producers are very important for the market supply and we all need them to stay. So if that is the case, since.. It could get worse, the Wall Street Journal reports: ���The euro is likely to drop to parity with the dollar by the end of 2016 and could fall to 90 cents by the end of the following year,��� in a research note by GS Robin Brooks, Fiona Lake and Michael Cahill. Lets illustrate.

The Divergent World of 2015

At Novembers OPEC meeting in Vienna, Saudi oil minister Ali al-Naimi said that although falling oil prices would be painful, losing customers to U.S. shale would be worse. Yet it is not clear that American producers will be the biggest victims of the.

Oil Market Karma: US Shale Oil And OPEC - Seeking Alpha

Research analyst, commodities, macro, natural resources. Profile| Send. Irans contribution to OPEC production was around 12% in 2008, dropping in 2013 to 8.6%, according to a recent Wall Street Journal article. Iraqs gains. U.S. supply itself is not a huge threat to OPEC.. In fact, the Permian Basin, with its varied geologic plays within plays, is another proving ground beyond the learning that has already occurred in the booming Bakken and Eagle Ford Shales.

US Shale Oil: The Convergence of a Global Commodity, US Policy, and Local.

As the uncertainty of long-term cheap oil looms, the question for many communities is no longer how to adapt to a new industry but what to do if the oil and gas industry leaves. --. Hydraulic fracturing (fracking), horizontal drilling and 3D seismic.

Oil Tanks After OPEC Fails to Cut Production; US Shale Gas.

WSJ on OPEC price reaction. The ripple effects hit currency markets and, of course, energy stocks. The Wall Street Journal emphasized the potential upside for the US economy, with lower energy prices giving consumers more money to spend elsewhere. Energy importing... I think the call for sustainable use of our natural resources on a global and national level is absolutely essential if we want the next generation to have a decent life on earth. But I just think the��.

Marcellus and Utica Shale Story Links: Wed, Nov 26, 2014.

Wall Street Journal The board of trustees at the City University of New York is debating whether to sell millions of dollars in investments in fossil-fuel companies amid growing demands from students, faculty and lawmakers.. Akron (OH) Beacon Journal Ohio has approved 1,638 Utica shale permits, as of Nov. 22. That total includes 1,200 drilled Utica wells and 698 Utica wells in production, says the Ohio Department of Natural Resources. Ohio has 52 drilling rigs at��.

Why Gas Feels Cheap���and Why Its Not, Historically Speaking

U.S. gasoline prices are the lowest theyve been in five years. And they feel even cheaper because they come on the heels of the highest gas prices consumers have paid in three decades. In 2012, the national annual average for a gallon of regular.

Fracking industry about to crash - Daily Kos

now that it sending, wall street has to unload the bonds not keep them.. As the die offs in wild animals extend to include domestic farm animals and we all start going hungry and cant breathe, perhaps we will be less concerned about the profits of big energy and whether or not wall street... I hope this sticks a spike in the popularity of the Canadian tar sands, but dont hold out a lot of hope that it will reduce the fight over fracking in areas that produce natural gas.

Crude Oil Prices: The Politics, Implications, and Backlash

Jon Ogg, writing at 247Wall St.com, noted that the precipitous drop in crude oil prices ���has serious implications for consumers and companies alike,��� and not all of them are unblemished blessings.. The ripple effect bodes well, too, for airlines.

Can OPEC Kill the U.S. Oil Boom? | Foreign Policy

A Not-So-Happy Hanukkah for Israels Natural Gas Industry �� Keith Johnson | 4 weeks ago... But most importantly, thanks to technological advances, it has gotten steadily cheaper to produce tight oil from blasting apart shale seams deep underground. That means that the.. Dreazen arrived in Iraq in April 2003 with the Fourth Infantry Division, and spent the next two years living in Baghdad as the Wall Street Journals main Iraq correspondent. Dreazen has made��.

The Best (and Worst) Investments They Ever Made

The Wall Street Journal asked successful people in the world of finance and beyond about the best or worst investments they ever made. Responses came from a. Telmex could easily have gone bankrupt, but not a dozen or two whole markets. Mellody.

Can OPEC Survive the Shale Gale? - Daily Resource Hunter

Just last week, Saudi Arabia announced it would cut its oil prices ahead of the next OPEC meeting, in an attempt to keep up production in the face of downward.. ���Price Drop Tests Oil Drillers��� the B-section of todays Wall Street Journal reports. So while lower oil. Its not easy to say, thats for sure.. Although always familiar with the financial markets, his main area of expertise stems from his background in the Agricultural and Natural Resources (AGNR) department.

Peak Oil Review - Oct 13 - Resilience.org

US crude prices have fallen another $10 a barrel in the last month and drillers in North Dakota are facing mandates to reduce flaring of natural gas associated with oil production and ship their oil in a safer manner thereby further increasing costs of production.. Libya: A member of the Libyan Parliament holed up in Tobruk far from the capital told the Wall Street Journal last week that Libyan oil production will hit 1 million b/d this month and 1.2 million early next year.